Hermes Birkin bags

Mehdi Fedouach | AFP | Getty Images

The artist Jean-Michel Basquiat has nothing on the Birkin bag.

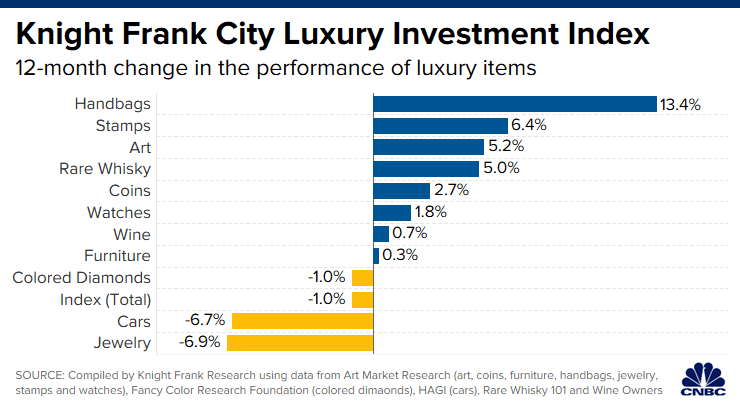

Handbags were a far better investment last year than art, according to according to a new report. While art had an overall return of 5% in 2019, handbags clocked in a 13% gain, making it the number one collectible investment for the year, according to the Knight Frank Luxury Investment Index, published by real-estate brokerage giant and wealth-researcher Knight Frank.

Knight Frank said that while the handbag market – which has exploded at auction and online sales – is being driven by a variety of brands, the Hermes Birkin dominates the high-end of the market. Birkin bags increased 13% in value in 2019, according to the report.

“Although bags made by other luxury brands like Chanel and Louis Vuitton are also highly collectible, it is those made by Hermes that attract the highest prices and are considered the most desirable,” according to Sebastian Duthy, director of Art Market Research.

The most expensive handbag ever sold was a white Himalaya crocodile diamond Birkin, auctioned by Christie’s in 2017 for $379,261. The Himalaya Birkin, considered the Holy Grail of handbags, is crafted from Nile Crocodile hide and treated with a special dye process that turns it a special white that fades to a smoky grey. It’s unknown how many Himalayan Birkins Hermes has ever produced, but their numbers are small, experts say.

Birkin makes about 12,000 Birkin bags a year in total, according to Bernstein Research, but Hermes typically limits their sale to top clients.

This was the first year Knight Frank included handbag prices in its ranking of collectible-investments, since the number of handbag auctions and online sales has now reached critical mass to reliably track their values over time. Over a 10-year-time period, handbags have more than doubled in value, up 108%.

After handbags, the second-best performing collectible investment in 2019 was stamps, at 6%. Rare whisky clocked in a 5% gain, matching the gains for art. While the art market clocked in jaw-dropping prices in 2016 and 2017 – including $110 million for a painting by Basquiat in 2017 – the market has continued to slow for the second straight year on a weaker supply of great works offered for sale and more lackluster bidding from foreign buyers.

Watches notched up a 2% gain in 2019, while wine notched up a 1% gain.

The worst performing collectible asset-class last year were classic cars and jewelry, which were both down 7%.