Investor Paul Meeks sees record upside in technology stocks.

Meeks, who’s known for running the world’s largest tech fund during the dot-com bubble, reveals he’s just as passionate now — and he’s making a big bet on semiconductors.

“We’re now seeing tech as not only the obvious upside winner, but believe it or not despite what had been perceived as volatility, a place that is a relatively safe haven even on market down days,” the portfolio manager at Independent Solutions Wealth Management told CNBC’s “Trading Nation” on Thursday. “That’s new, and I think that’s pretty interesting.”

It’s a significant shift for the long-time tech investor. Meeks had been bearish on the group for more than a year. In late February, he warned on “Trading Nation” that the coronavirus could spark a bear market in technology.

Now, he believes the tech-heavy Nasdaq, which is 2% away from all-time highs, will be up at least another 10% by this time next year.

Meeks cites a fundamental change as the economy tries to rebound from the coronavirus pandemic, and that’s where he sees sustainability.

“What we’re seeing during Covid is an acceleration from analog to digital,” Meeks said. “That is one of the reasons why tech stocks have done so well during Covid when the rest of the markets have been damaged.”

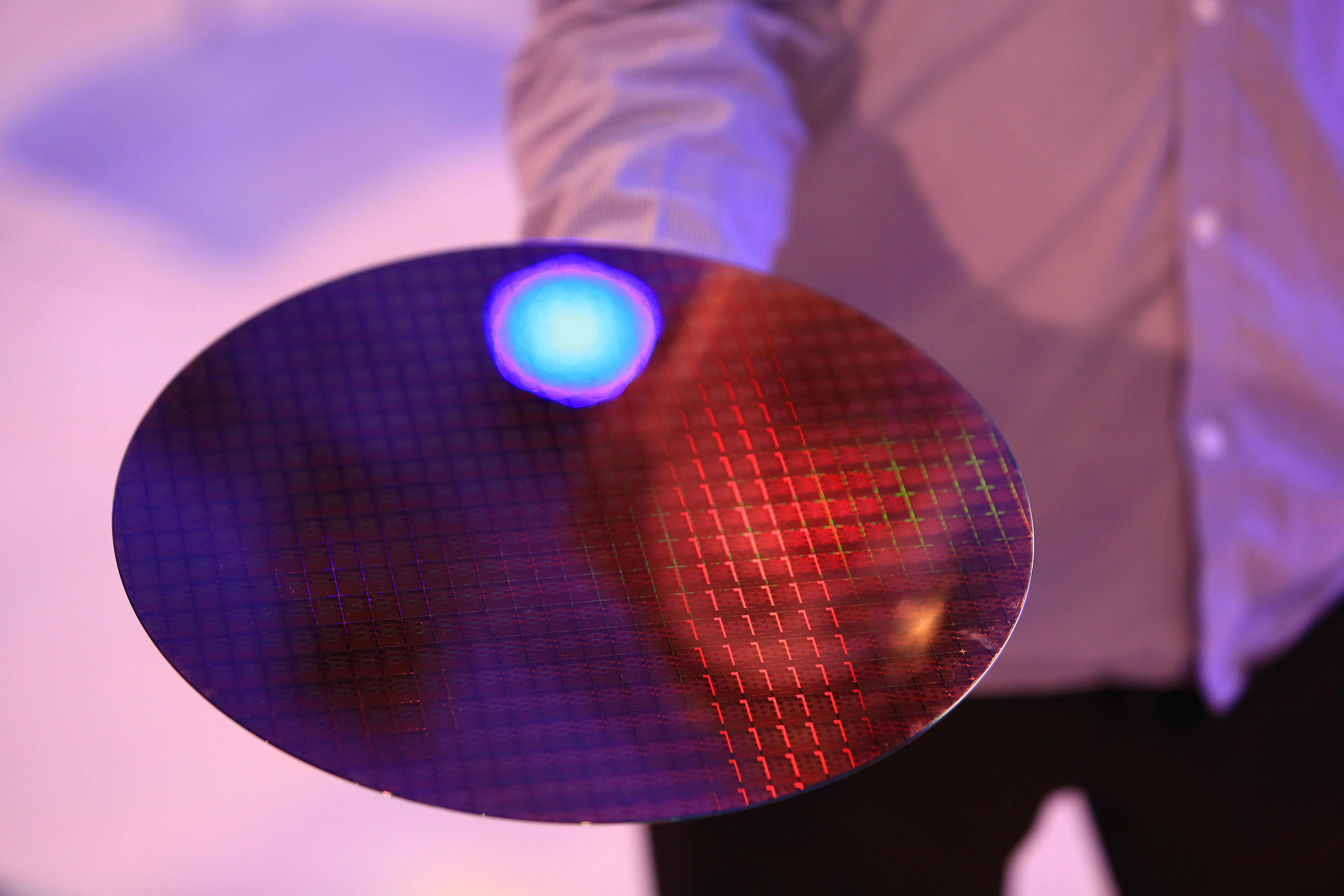

Betting big on semis

On Wednesday, he shifted a big chunk of money into semiconductor stocks, including Micron, Marvell and Qualcomm.

“I feel good enough about tech recently to go from an underweight semiconductor bet to an overweight bet,” said Meeks. “It’s played out very nicely the past couple of days.

According to Meeks, the group will bounce back stronger than hardware and software.

“The key decision you have to make is when it’s time to be risk on, you need to be heavy semiconductors,” Meeks said.

The VanEck Vectors Semiconductor ETF, which tracks the group, is up 8% in the past week. It has rallied 48% since the March 23 bottom while the tech-heavy Nasdaq has surged 40%.