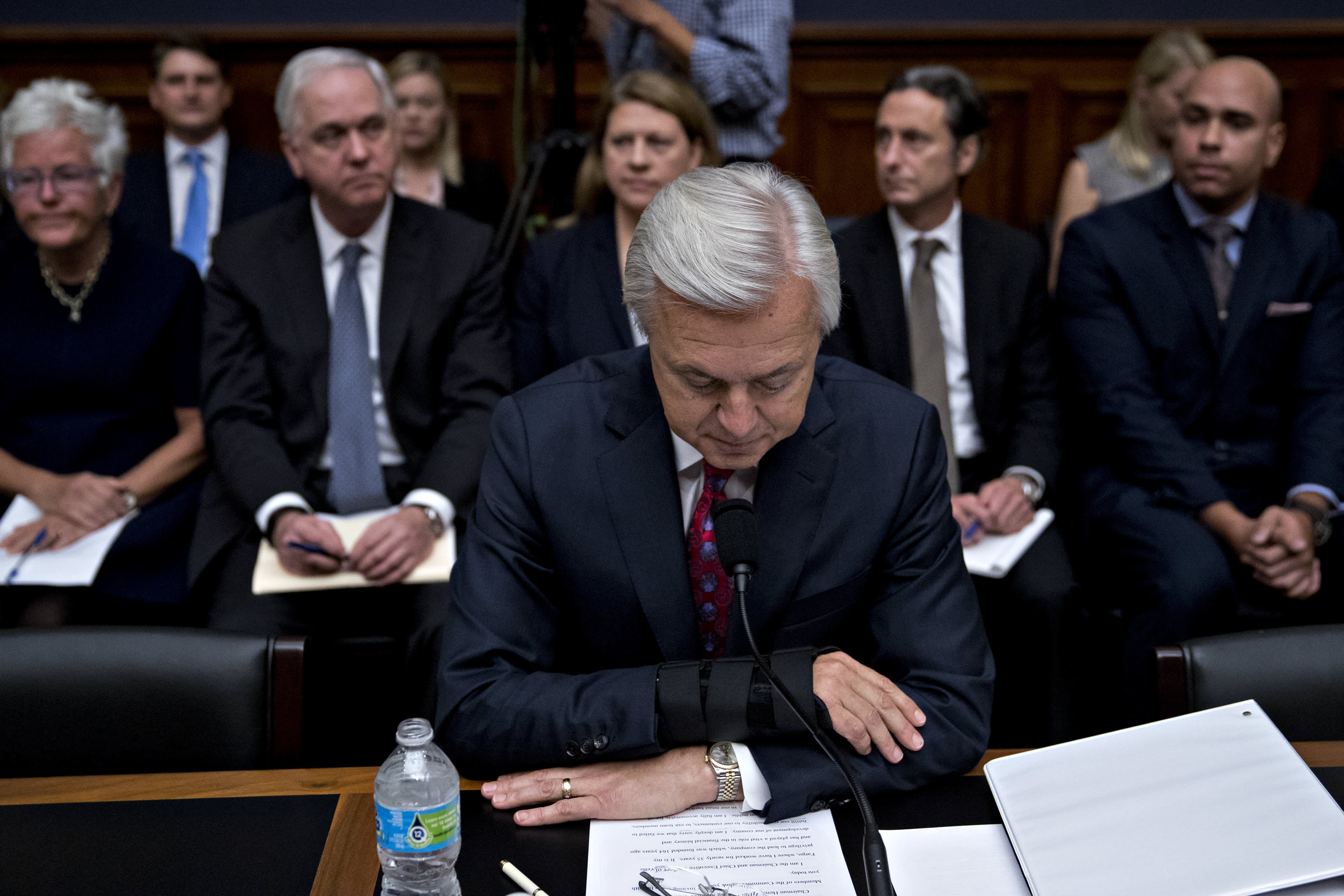

John Stumpf, chief executive officer of Wells Fargo & Co., waits to begin a House Financial Services Committee hearing in Washington, D.C., U.S., on Thursday, Sept. 29, 2016.

Andrew Harrer | Bloomberg | Getty Images

Ex-Wells Fargo CEO John Stumpf and his former deputy Carrie Tolstedt were charged by the Securities and Exchange Commission Thursday for allegedly misleading investors about the bank’s success in selling multiple products to customers.

The bank’s two former leaders certified investor disclosures in 2015 and 2016 that touted the firm’s supposedly robust “cross-sell” metric, an industry term for how many products a single customer has, despite knowing that the metric was misleading, the SEC said in a statement.

Wells Fargo was later found to have inflated that metric by putting millions of customers into products without their consent, a scandal that cost Stumpf his job in 2016 and even that of his successor Tim Sloan. Current CEO Charlie Scharf took over a year ago and has been tasked with overhauling the fourth biggest U.S. bank and satisfying regulators’ demands for better controls.

“If executives speak about a key performance metric to promote their business, they must do so fully and accurately,” Stephanie Avakian, director of the SEC’s Division of Enforcement, said in the statement.

Stumpf agreed to pay a $2.5 million civil penalty to resolve the matter, and that allowed him to avoid admitting or denying the SEC’s charges. Meanwhile, the SEC’s complaint, filed in California, charges Tolstedt with fraud and seeks penalties and to ban her from being a public company’s officer or director.

According to the SEC’s complaint against her, Tolstedt publicly endorsed the firm’s vaunted cross-sell metric from 2014 through 2016, despite the fact that it was “inflated by accounts and services that were unused, unneeded, or unauthorized.”

Earlier this year, Wells Fargo paid $3 billion to settle a swath of U.S. probes into its operations, including a $500 million deal with the SEC. The regulator said it will distribute money collected from Stumpf and the bank to investors.