After a massive rally, the value of the cryptocurrency market tanked on Monday by over $200 billion. Bitcoin, the largest cryptocurrency, fell more than 12% in a day, and ether, the second largest, fell 23%.

And crypto bears are not surprised.

Even as the price of bitcoin hit a record high of over $41,000 on Friday, those wary of it warned that it may crash like it did in 2017, and likened it to a market bubble.

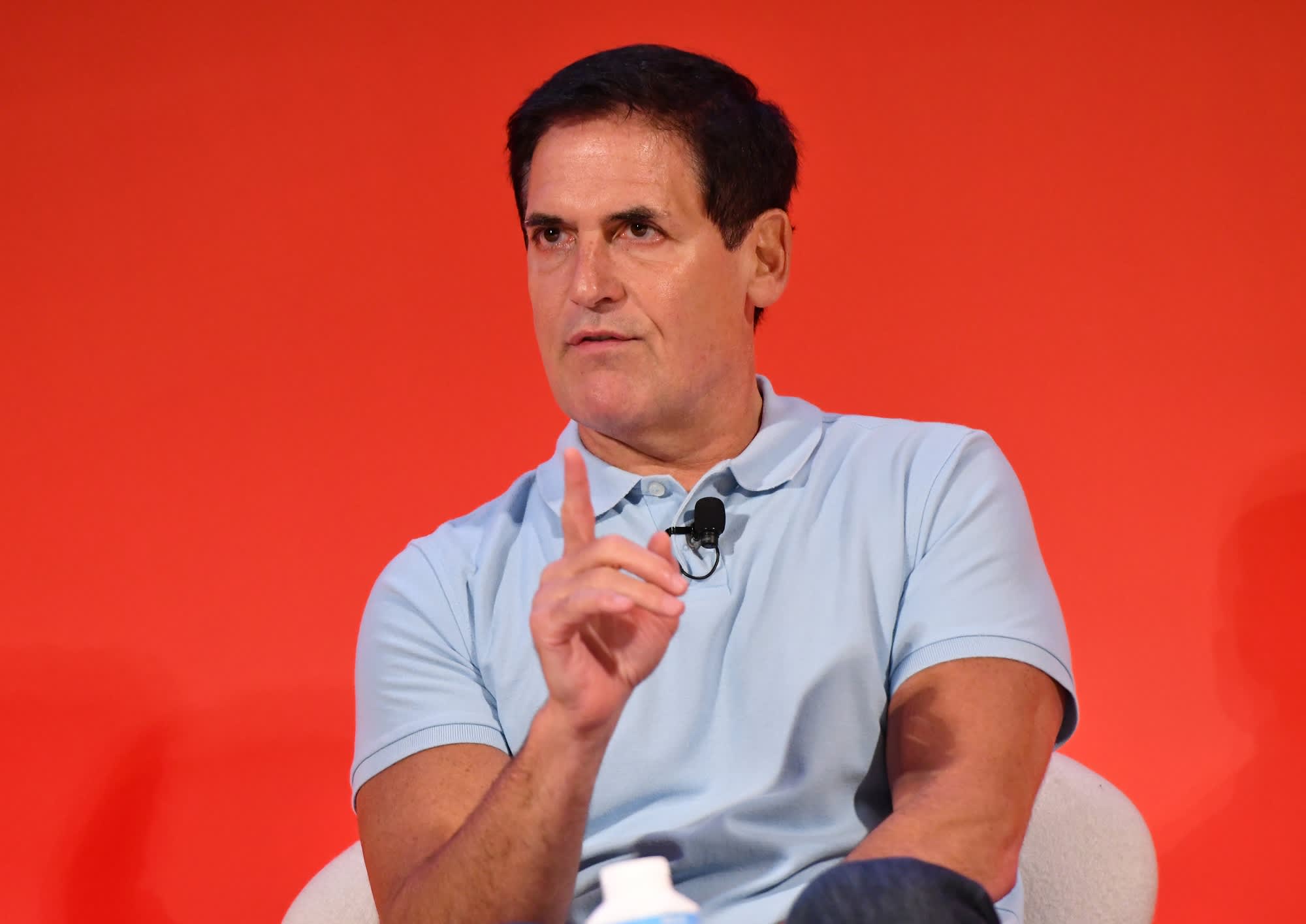

Among them is billionaire Mark Cuban, who compared the current cryptocurrency market to the dot-com bubble burst of the early 2000s, which was caused by speculation in unproven internet stocks.

“Watching the cryptos trade, it’s EXACTLY like the internet stock bubble,” Cuban, investor on ABC’s “Shark Tank” and owner of the Dallas Mavericks, tweeted on Monday.

“As during the dot-com bubble, ‘the experts’ try to justify whatever the pricing of the day is,” Cuban added.

But, Cuban admits, “I think [bitcoin], [ether], a few others will be analogous to [companies] that were built during the dot-com era,” which “survived the bubble bursting and thrived.”

Although Cuban himself has previously invested in businesses built on cryptocurrency, and even in bitcoin, he frequently warns against it, calling bitcoin a “gamble.”

“If you’re a true adventurer and you really want to throw the Hail Mary, you might take 10% [of your savings] and put it in bitcoin or ethereum,” Cuban said in a 2017 interview with Vanity Fair. “But, if you do that, you’ve got to pretend you’ve already lost your money.”

Some in favor of bitcoin say it’s a hedge against inflation and the U.S. dollar, and that it will survive any economic or infrastructure collapse, comparing it to gold. Since the supply of bitcoin is limited by its design, bitcoin bulls say its price will increase as demand increases.

To that argument, Cuban says crypto, much like gold, is driven by supply and demand. But, “all the narratives about debasement, fiat, etc. are just sales pitches. The biggest sales pitch is scarcity vs. demand. That’s it,” he tweeted on Monday.

In December, Cuban told Forbes that bitcoin is “a store of value…that is more religion than solution to any problem.” Neither bitcoin nor any cryptocurrency will replace fiat, or government-backed, currency, he added.

“Along the way, MANY fortunes will be made and LOST,” Cuban tweeted on Monday. “My advice? Learn how to hedge” — or offset a potential investment loss, as he successfully did during the dot-com boom.

If you are accumulating debt “that you can’t afford to pay back” by investing in crypto, stocks or other currencies, however, “you are a fool,” Cuban tweeted. “There is a [99%] chance you will lose EVERYTHING. Personal disaster stories are built on leverage.”

Disclosure: CNBC owns the exclusive off-network cable rights to “Shark Tank.”

Check out: