Indonesia is renowned for its millions of traditional family-owned street stalls, or “warungs.” But behind the scenes of many of them is a multibillion-dollar business.

And as it helps small businesses modernize, retail start-up Bukalapak is hoping to revive an iconic segment of the country’s economy.

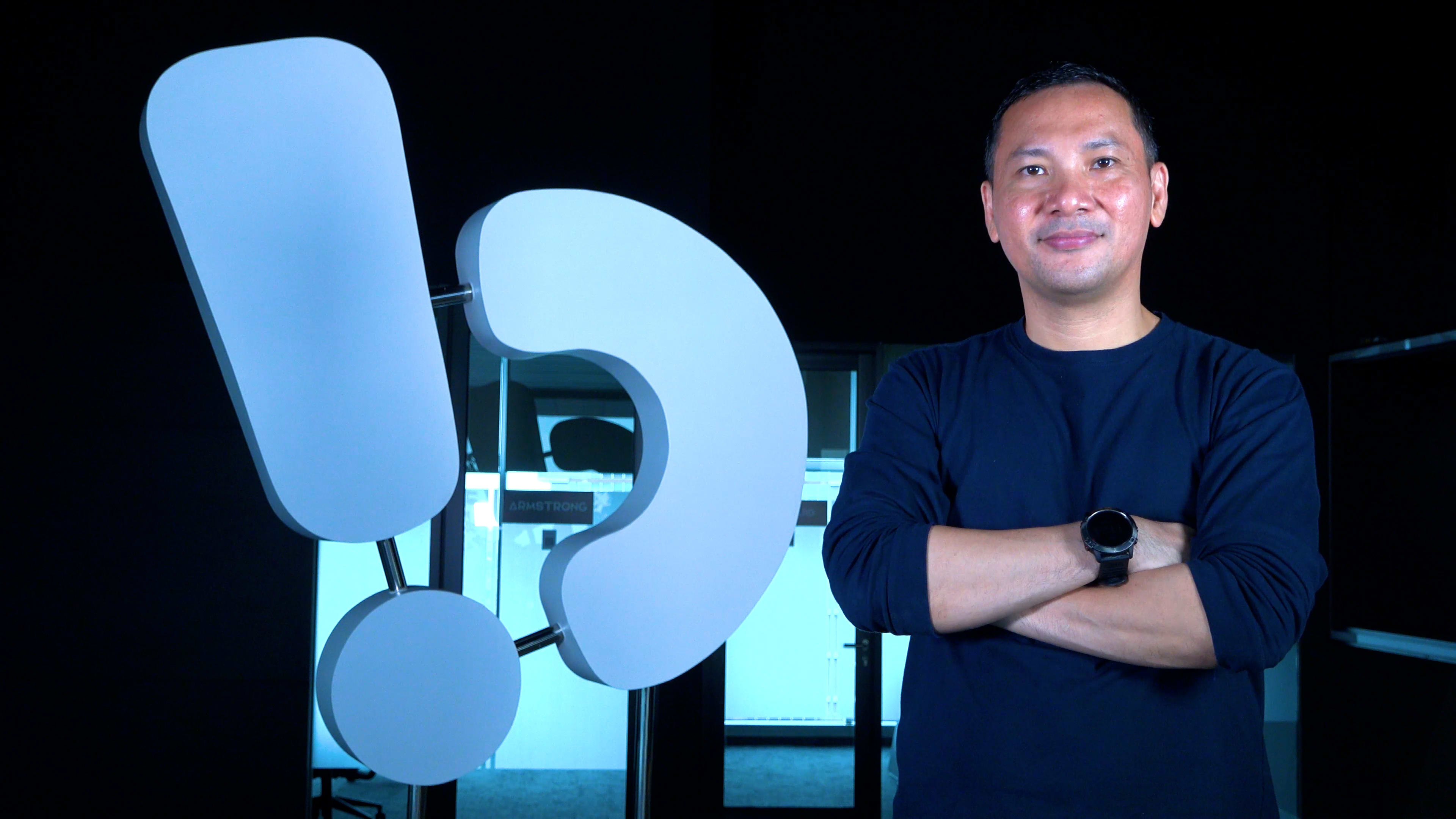

“Every maybe 50 or 100 houses, there will be one of these guys who opens a shop in their house and they sell basic goods: Water, soap, coffee or whatever. They have been like that since the beginning and, as the economy grew, they are basically left behind,” Bukalapak CEO Rachmat Kaimuddin told CNBC Make It.

A neighborhood business

Bukalapak is an Indonesian e-commerce marketplace designed to help the country’s millions of mom-and-pop kiosks come online.

Today, the company boasts tens of millions of customers across the sprawling archipelago. But when it was founded in 2010 by Achmad Zaky, it was simply a way to help his neighbors.

Bukalapak’s co-founders Achmad Zaky, Nugroho Herucahyono and Fajrin Rasyid.

Bukalapak

“My predecessor, Zaky, one day went back to his hometown,” said Kaimuddin. “He saw all these small businesses, his neighbors, and he was taken aback and realized these guys have looked the same for decades.”

“Now I know technology, I’ve learned about the internet and everything, and I wonder how could I … help people improve, do better,” he said.

The capital he used to start this company is just the registration fee to register the website … maybe about $5.

Rachmat Kaimuddin

CEO, Bukalapak

So, Zaky, who was then a 23-year-old student, teamed up with his friends Fajrin Rasyid and Nugroho Herucahyono from the Bandung Institute of Technology to create a site to help small businesses sell online.

“The capital he used to start this company is just the registration fee to register the website. It’s like 80,000 rupiah or maybe about $5. That is the seed capital of Bukalapak,” said Kaimuddin.

Supporting small sellers

Before long, Bukalapak was live, acting as a third-party intermediary to support purchases between consumers and merchants. But the company’s real breakthrough came some years later.

In 2017, the company launched Mitra Bukalapak to help these shops compete with modern retailers by offering additional online services such as bill payments and phone top-ups.

Bukalapak CEO Rachmat Kaimuddin meets with Mitra Bukalapak stall owners during the pandemic.

Bukalapak

Mitra Bukalapak also connects warungs to consumer goods distributors, narrowing their supply chain, lowering the cost price of their wares and increasing the profit margins for those micro businesses.

In the same year, the company, which earns a commission for each transaction, reached a billion-dollar valuation.

Leading through the pandemic

In January 2020, after a decade at the helm, Zaky stepped down as CEO. Kaimuddin, a 41-year-old former banker, was selected as his successor. Zaky, who now runs an entrepreneurship foundation, still holds an advisory role with the company, while co-founders Rasyid and Herucahyono have both left the firm.

“Zaky (was) basically saying, look, I’ve led this company from zero and it’s probably time for me to extract myself. We probably need someone who can make this (company) more professional, bigger, and we see that you could help us. I was like, okay. Really?” said Kaimuddin.

Failure is not an option: We cannot just give up and say like, okay, Covid, let’s take a break … People actually need us.

Rachmat Kaimuddin

CEO, Bukalapak

However, within Kaimuddin’s first 100 days in the job, the pandemic struck. The subsequent lockdowns hit the millions of warungs and small and medium-sized enterprises hard. Bukalapak had to step up.

“We need to ensure that the SMEs can still transact. The only way to do that now, or at the time, was online. So, our task is to create a much more efficient onboarding process,” he said. “Failure is not an option: We cannot just give up and say like, okay, Covid, let’s take a break for a year. People actually need us.”

E-commerce on the rise

E-commerce, meanwhile, has been one of the pandemic’s big winners. In 2020, Indonesia’s digital consumers surged 37% as lockdowns led more people to try new services online. In the same year, online spending rose 11% to hit $44 billion. By 2025, that figure is expected to almost triple to $124 billion.

Bukalapak has ridden that wave, recording a 130% surge in transactions in 2020. The company now serves 13.5 million micro, small and medium enterprises and 100 million customers.

That rapid adoption should help Kaimuddin with his primary task — reaching profitability.

“This is a big organization and we want to be there for a long time,” he said. “Of course, growth is nice and we all want to have more growth, more transactions, more customers. But we need to see whether we can create an organization that can be self-sustaining moving forward.”

Indonesia’s growth opportunity

That hasn’t stopped investors from piling onto the business.

In January 2021, Standard Chartered bank became the latest corporation to join a $200 million funding round to fuel the company’s expansion. The partnership will help build Bukalapak’s digital banking service, while a separate deal with Microsoft will see the company adopt the tech giant’s Azure cloud computing platform.

Other investors include Indonesian media conglomerate Emtek, Alibaba-affiliate Ant Group and Singapore’s sovereign wealth fund GIC, pushing the company’s estimated valuation to between $2.5 billion and $3 billion.

Folks feel the demographic dividends are going to pay off: 270 million people, most of them with smartphones now.

Khailee Ng

managing partner, 500 Startups

That ranks the 11-year-old company among Indonesia’s growing number of unicorns, which include fellow e-commerce player Tokopedia, ride-hailing giant Gojek and travel site Traveloka. The world’s fourth most-populous country has the largest number of internet users in Southeast Asia, and analysts say it has potential for more growth.

“A lot of folks feel the demographic dividends are going to pay off: 270 million people, most of them with smartphones now,” said Khailee Ng, managing partner of 500 Startups and one of Bukalapak’s early investors. “What is super fascinating to me is that how much of that investment goes into tier-one city-targeted business models, versus Indonesia business models.”

Preparing to go public

Still, some analysts are skeptical about Bukalapak’s ability to expand beyond Indonesia, given its hyperlocal roots. But Kaimuddin says he is confident that the company has plenty of room to grow.

“I’m not going to say that we just want to stay in Indonesia,” he said. “But Indonesia, today, is a big enough market to keep us very busy, and we still feel like we have a lot of homework to do. I don’t think we’ve even scratched the surface if you talk about underserved markets in Indonesia.”

Street vendors sell fresh produce at an Indonesian market.

Getty Images | photo3idea