Salesforce topped analysts’ estimates for profit and revenue in its fiscal fourth-quarter earnings report. The stock jumped in extended trading.

Here’s how the company did:

- Earnings: 84 cents per share, adjusted, vs. 74 cents per share as expected by analysts, according to Refinitiv.

- Revenue: $7.33 billion, vs. $7.24 billion as expected by analysts, according to Refinitiv.

Revenue increased 26% in the quarter, which ended on Jan. 31, according to a statement.

For the first quarter, Salesforce called for revenue of between $7.37 billion and $7.38 billion. Analysts polled by Refinitiv had expected $7.26 billion in revenue.

The company’s updated guidance for the 2023 fiscal year is $32 billion to $32.1 billion in revenue. Analysts surveyed by Refinitiv had been looking for $31.78 billion in revenue.

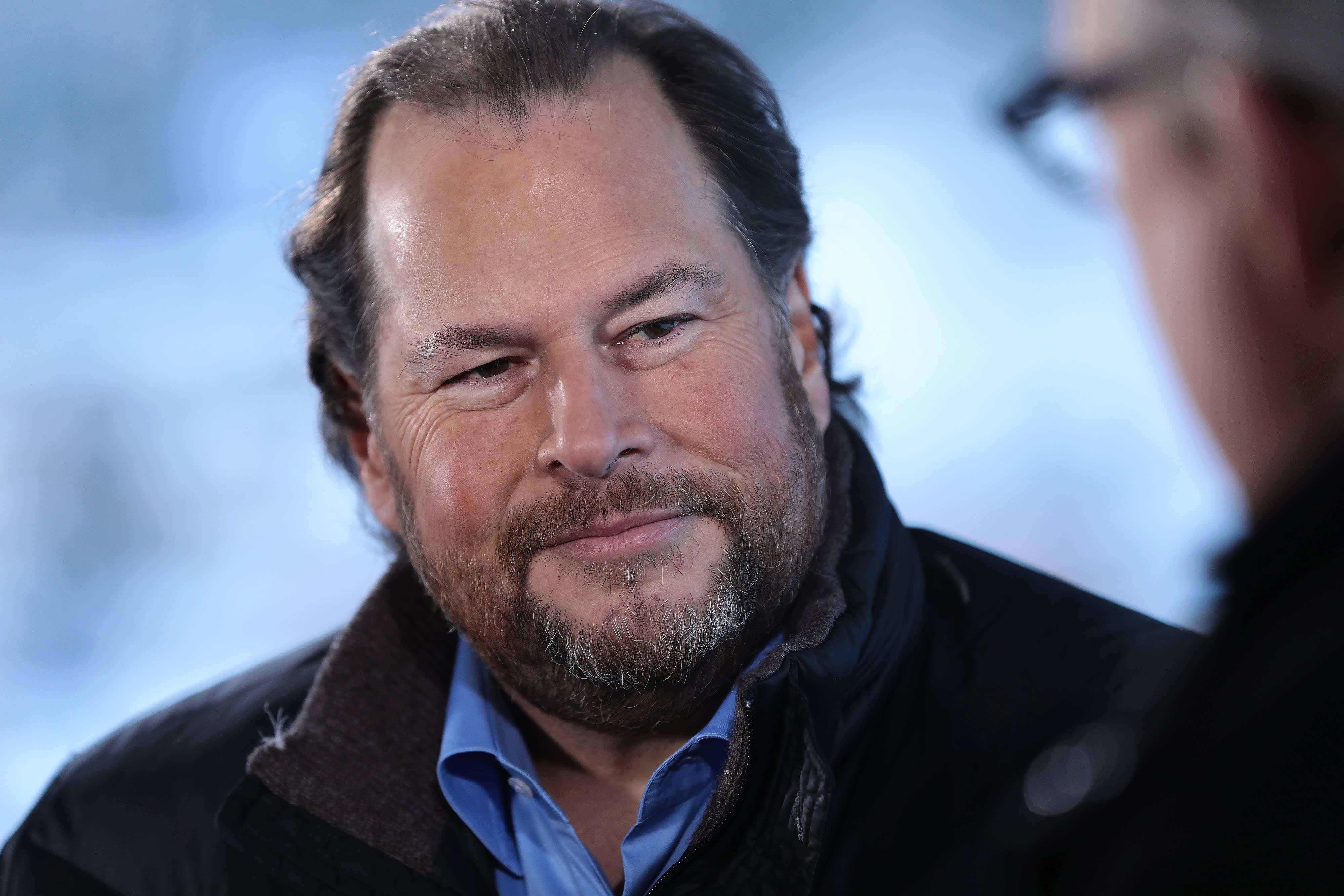

During the period, Salesforce promoted Bret Taylor to co-CEO alongside Marc Benioff, the company’s billionaire co-founder. Taylor joined Salesforce in 2016 through the acquisition of productivity software start-up Quip and quickly rose up the ranks to become chief operating officer.

Prior to the after-hours move, Salesforce has dropped 15% so far this year, underperforming the S&P 500, which is down about 10%.

Executives will discuss the results with analysts on a conference call starting at 5 p.m. ET.

This is breaking news. Please check back for updates.