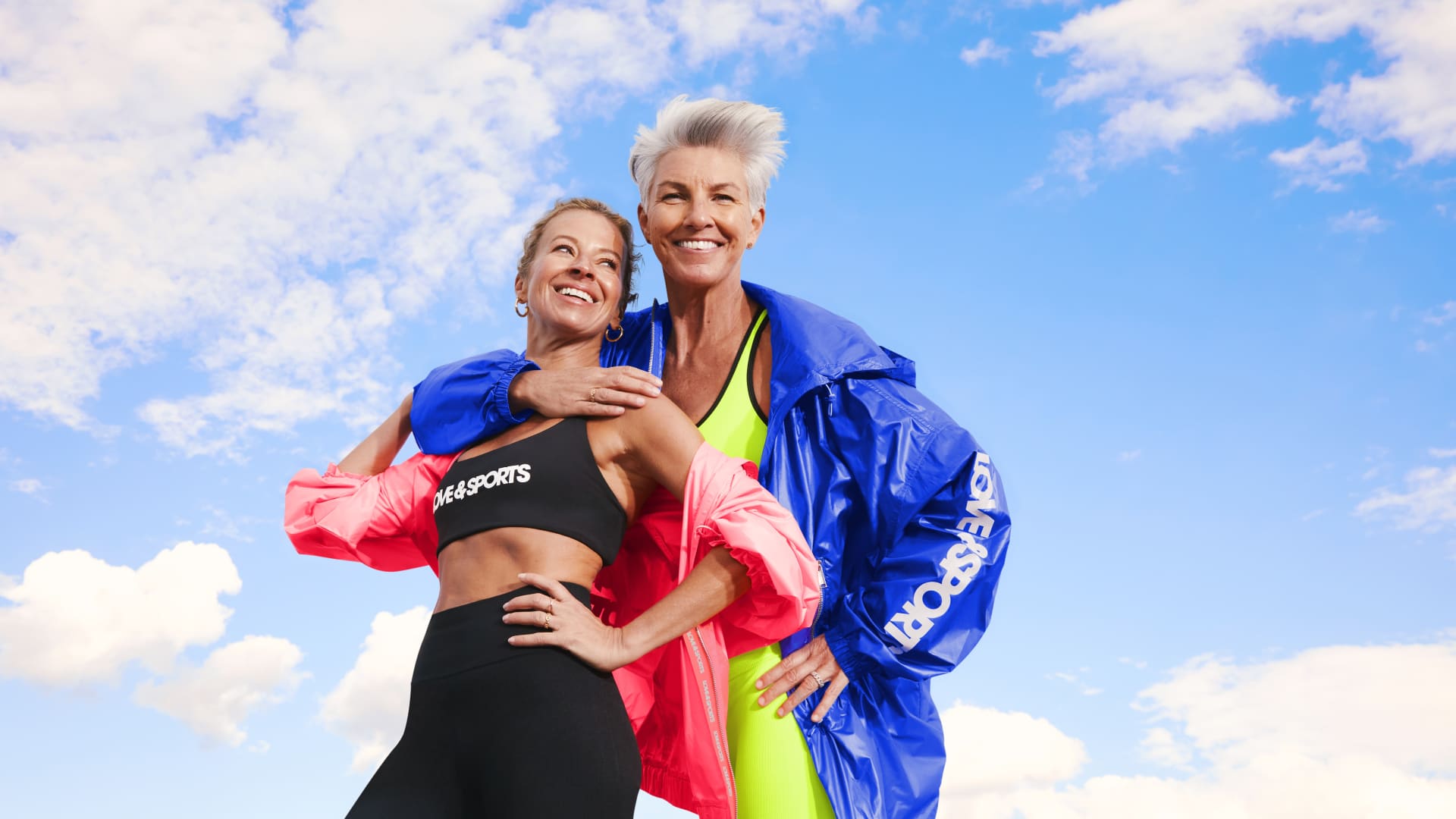

Over the past two years, fashion designer Michelle Smith and SoulCycle instructor Stacey Griffith have touched dozens of fabrics, spitballed brand names and tried out samples of sports bras and leggings when lounging at home or sweating during workouts.

Now, the New York City-based couple is revealing their secret project: Love & Sports, an elevated activewear and swim brand that they are debuting with Walmart. The new brand hits the big-box retailer’s website on Friday and is rolling out to 1,500 stores.

“I think some of our friends actually thought we were having a baby because we couldn’t talk about something and said, ‘We can’t go. We have something to work on,'” Griffith said.

“I guess we kind of are having a baby,” Smith said, with a laugh.

Smith co-founded high-end apparel brand Milly and designed the dress worn by Michelle Obama in her Smithsonian portrait. Now she has a newer, eponymous line of sleek items, from silk camisoles to alpaca coats, that can run as much as $2,750 apiece.

Meanwhile, Griffith has gained a fan-following as an indoor cycling teacher and gone on a motivational tour with Oprah Winfrey. The designer and fitness instructor met — and later started dating — thanks to a SoulCycle class.

The fashion-forward clothing collection is another sign of the retailer’s efforts to shake up its reputation and become known as a place where shoppers can find stylish garments along with milk, bananas and TVs.

Walmart has launched a growing number of exclusive and elevated fashion names, including Sofia Jeans, a denim brand developed with actress Sofia Vergara; Eloquii Elements, a plus-sized women’s brand inspired by acquired brand Eloquii; Scoop, a trend-forward womenswear brand; and Free Assembly, an apparel line of everyday wardrobe pieces for men, women and kids.

It has also tapped the star power of other fashion names, notably in the hiring of Brandon Maxwell — who has dressed famous women including Lady Gaga — as creative director of Scoop and Free Assembly.

Walmart, which still gets the majority of its annual revenue from the grocery business, does not break out apparel sales from other general merchandise, such as home decor and electronics.

Denise Incandela, executive vice president of apparel and private brands for Walmart U.S., said the retailer was drawn to Love & Sports’ unique designs and bold colors. She said teaming up with Smith and Griffith created an opportunity to stand out in a category where high quality usually comes with a high price.

The idea for the new brand was born when Smith reached out to Incandela through a direct message on Instagram in the early months of the pandemic. Incandela, an alumna of Saks Fifth Avenue, knew Smith because the luxury chain carried her Milly clothing line.

Smith later shared some initial sketches that she had worked on for a few months. “It’s just such a natural extension of Stacey and myself that it almost designed itself,” she said. “It just flowed through onto paper.”

Smith, who trained at elite fashion houses like Hermes and Louis Vuitton, said that she and Griffith were looking to make clothes that fit both budgets and bodies.

The brand’s first collection includes 121 pieces that range in price from $12 to $42. It includes retro running shorts, cropped sweatshirts and seamless bras. It ranges in size from XS to XXXL for activewear and up to XXL for swimwear.

Items have details that blend street fashion and fitness, such as lots of pockets for cell phones, invisible zippers on the inside to secure credit cards and waistbands that can be worn high-waisted (Smith’s preferred style) or rolled down for a low-waisted look (Griffith’s preference).

Love & Sports will add footwear and accessories, including sneakers and handbags, in the fall.

Activewear has become a hotter, but more crowded, field during the pandemic. Sales in the men’s and women’s apparel category rose from $52.3 billion in 2019 to $70.8 billion in 2021, a 35% increase during the two-year period, according to The NPD Group. The market research group includes all apparel items with active features such as moisture-wicking fabric.

Kristen Classi-Zummo, an industry analyst who covers fashion apparel for The NPD Group, said some observers bet that as the pandemic receded, people would step out into the world dressed up again and eager to don formal attire like in the Roaring ’20s.

Instead, she said, people have largely looked for comfortable and versatile pieces that fit into a hybrid way of life, such as pants with enough stretch to allow a quick walk around the block between virtual meetings or a longer sports bra that can pair with workout leggings as well as jeans and heels.

As the category has boomed, however, so has the number of brands vying for market share. The number of activewear brands has climbed from 1,600 in 2014 to 2,400 in 2021, according to NPD. That field includes players from Lululemon and Nike to private labels launched by the likes of Target, Kohl’s and Dick’s Sporting Goods.

Classi-Zummo expects activewear to remain popular this year and beyond, but have a slower growth rate than the double-digits in 2021 — and that, she said, will heighten competition for consumers.

“We still anticipate it will grow, but what is a brand to do in a marketplace that’s seeing less growth and a lot more competition?” she said. “She’s been buying activewear for years. She doesn’t need another pair of black leggings. What special features, what new fit, new fabric can you offer to keep her or him interested in the category?”

Griffith said Love & Sports was inspired, in part, by a pandemic-related shift to “an era of yummy fabrics.”

She said she’s already secretly sported the brand in SoulCycle classes, but hid sports bras beneath tops and worn pairs of shorts without a logo. Now, though, she’s looking forward to her big reveal.